This is part of a series of articles about the final days of preparing for moving to France and what happens when you get here. This is the first of two promotional series launching our new book, 29 Days to … Continue reading

profession liberale

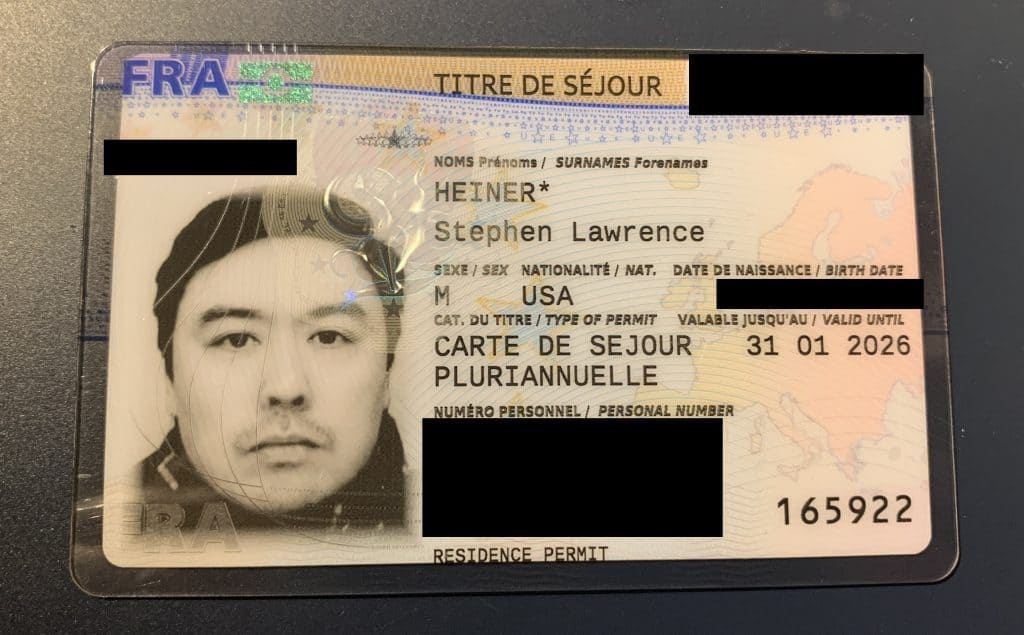

How to Renew a Four Year Profession Libérale Visa

I always tell readers of the blog that getting a visa is usually much more challenging than renewing one, for the simple reason that for the former you are trying to prove to the French that something is at least … Continue reading

Mailbag: the Non-Existent “American ban,” Work Possibilities with the PL Visa, & Snake Oil

In the last eight weeks I have received an avalanche of questions from those hoping to immigrate to France. In the past when I received a lot of questions I would collect them into a post like this and call … Continue reading

Visa Video Courses Posted

One of the things I did this summer during a trip to the US was film some video courses about subjects I knew very well. Two of those courses were about French immigration. I did one on the Long Term … Continue reading